Tax Tip #204

Ralph Loggia • July 16, 2024

Scams & Phishing

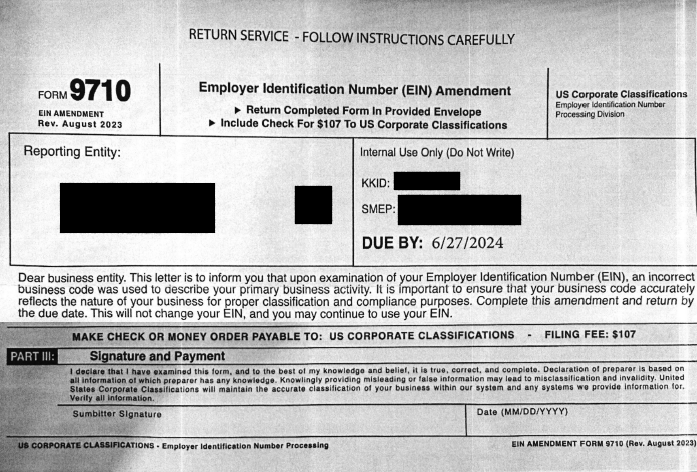

The IRS does not initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. This does not stop scammers from attempting to obtain personal information and money. Below is an example of a form sent to a Goldstein & Loggia client, which turned out to be a scam:

Upon first look, it appears to be a typical IRS tax form. However, not everything is as it seems. Receive something “phishy” and not sure if it is legit? Contact a team member for help.

Have you been a victim of identity theft? See Tax Tip #53 for more information.