Tax Tip #160

Interest Paid On A Balance Due

The last tip was about penalties. Now it is time to understand the amount of interest that needs to be paid when there is a balance due after the 4/15 tax deadline on an individual income tax return. For Federal purposes, the interest rate is the current Federal Short-Term Rate (5%) + 3% for a total of 8%. Example: Taxpayer files an extension with the IRS on 4/15/2023 & owes $1K but does not pay the balance due. The tax return is filed on 9/9/2023. The taxpayer owes 1K + a penalty + interest of $28.59 per this online calculator.

https://www.irscalculators.com/interest-calculator

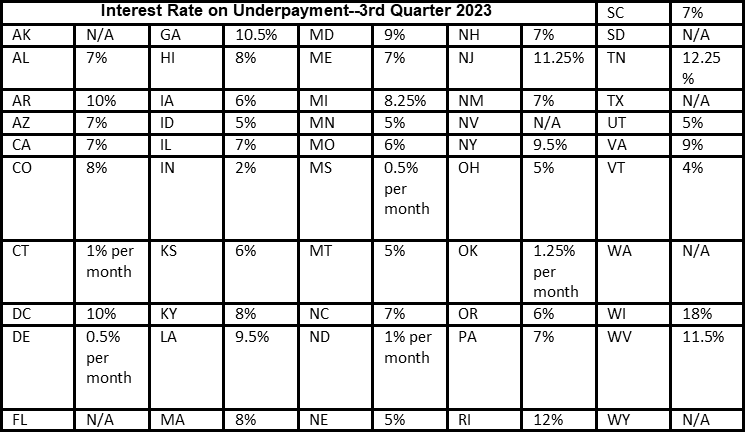

NJ’s current interest rate is 11.25%. NY is 9.5%. Tax planning tip: For a NY or NJ taxpayer, if money is due to both the state and the IRS and the funds are not available to pay both in full, pay the state off first since the interest rate is higher. Interested in another state: